7 Health Insurance Marketing Strategies for 2022

The health insurance industry is experiencing massive growth, with a market expected to grow up to $4 trillion by 2027. As the industry continues to boom, you can expect your competition to grow as well.

Prospects are using multiple channels to research health insurance companies. Businesses in the industry must have a solid strategy that engages them. That requires getting up to date with the latest digital marketing strategies and adopting the right technology.

In this blog post, we’ll dive into the key factors that determine a successful health insurance marketing plan, along with the best marketing tactics you can use to engage and enroll more members in your insurance program.

Table of contents

- Key things to keep in mind for an effective health insurance marketing strategy

- 1. Optimize your website for conversion

- 2. Invest in organic growth with SEO

- 3. Run PPC ad campaigns

- 4. Follow up with health insurance patients

- 5. Leverage co-marketing and partnerships to build authority in your health insurance niche

- 6. Leverage doctor referrals

- 7. Use marketing tools to automate manual work

- Key takeaways

Key things to keep in mind for an effective health insurance marketing strategy

A health insurance marketing strategy depends on various factors for success. Here are the key components insurers should consider as they set up a healthcare marketing strategy to attract more prospects.

Opt for multi-channel marketing over outdated tactics

In today’s age, health insurance companies must avoid sticking to one traditional marketing method, such as radio or direct mail, if they want to reach as many customers as possible. Most prospects are now using the internet to do their research. Here they expect to find fast information on the best health insurance (with the best pricing).

It’s only by targeting prospects across their most-used online channels that you’ll get the best results for your health plans. Prospects now expect a flawless digital experience. This includes the ability to message you on various marketing channels and devices. One of these important channels is social media. If you’re not maximizing social media as a health insurance company, you’re likely missing out.

According to a recent survey of over 1,000 U.S.-based adults, 76% of respondents sought health information about the Coronavirus pandemic on social media “at least a little”. Consumers are trusting health information from social media, which is great for marketing purposes, but comes with a legal and moral duty to provide accurate and honest information.

Another channel that’s important to optimize is email marketing. Email marketing is important for spreading information about your healthcare insurance.

One report found that 77% of companies saw more engagement with email marketing from 2020 to 2021. They also said, “Marketers this year are sending less weekly emails than last year, but prioritizing segmentation, personalization, and automation.” The bottom line here is that customers are engaging more with email marketing, but you’ll need to speak directly to your segments’ pain points in each campaign to stand out above the crowd.

Let’s dive into an example of what multi-channel marketing could look like if you’re a health insurance company for athletes.

Your marketing strategy could start with a PPC ad for the keyword “sports health insurance in California” to target your ideal customer. A prospect clicks on the ad at the top of their search results page to learn more about your insurance company. A live chat feature then pops up with questions on which type of sports insurance they’re looking for so you can identify which of your offers best fits their needs.

You can then ask the customer to sign up with their email address and send them content specific to how you can help with their problem. The idea here is to educate and nurture the customer, so they eventually book a call with your team.

Map out the healthcare buyer journey

As health insurance providers, finding customers should be based on your knowledge of the buyer journey. That means determining and understanding the different steps that your ideal prospect takes to learn more about your offer and adapt your marketing to each stage. In addition, it allows you to always send the right message at the right time to your ideal buyer.

For example, what channel does your ideal customer use to start learning about the best health insurance for their needs? Perhaps they start by asking a question in a Facebook group or by asking their doctor about the best options.

The buyer journey map will also vary across different segments of your customers.

Let’s say that a portion of your target audience is young (18–24 years old), and they’re worried about being able to afford your insurance on entry-level salaries. Learning their specific objections means you can encourage these types of prospects down the funnel by offering specialized financing options.

Top Tip: Learn what the buyer journey is and how to map it out in our customer journey ebook 🐼

Don’t forget about HIPAA compliance

Health insurance companies must make sure they’re compliant with regulations such as the HIPAA, a set of rules on how you must protect patient data. Non-compliance with these various regulations can result in hefty fines for your health insurance company.

The HIPAA rules prevent health insurance companies from using private patient data in their marketing campaigns. As a result, health insurance companies must be cautious if, for example, they plan to leverage patient data for personalized outreach.

1. Optimize your website for conversion

Driving traffic to your health insurance website is just the first step. To land the most deals, you must also ensure you optimize your page for conversions. Here’s how to do it:

Start with page speed

The best health insurance in the world won’t reach its potential with a poor-performing website. According to Google, 53% of visitors will leave (also called “bouncing off”) your website if it takes more than three seconds to load.

There are various tools you can use to determine the speed of your websites, such as Pingdom or Google’s PageSpeed Insights. You can also use self-led tactics to improve the speed of your health insurance website, which include:

- Moving to a more reliable hosting provider that promises fast page loading times

- Reducing the number of plugins to avoid slowing down your website with database requests from tools you rarely use

- Leveraging modern techniques like prefetching, preloading, and preconnecting, which begins processes like page retrieval and image downloads when users navigate around a link or scroll down the page

- Enabling browser caching, which saves the information already retrieved to speed up future website browsing experiences

Make your website mobile responsive

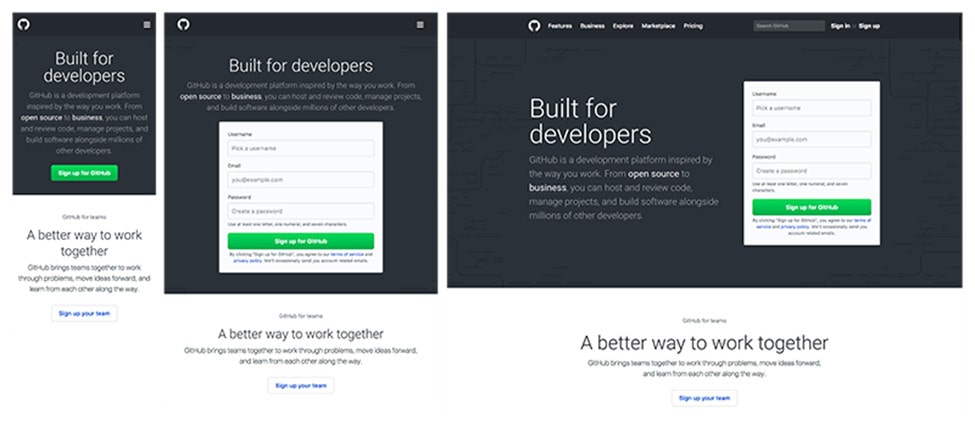

Your target customer will be using different devices to learn about the best insurance for their healthcare needs, such as their tablet or mobile device. In fact, worldwide mobile web browsing has now surpassed desktop web browsing.

It’s why you want to ensure that your website looks good across all formats. Here’s a great example of what mobile responsiveness across different devices looks like from GitHub.

Making your website responsive isn’t just crucial for the user experience. It’s also necessary if you’re trying to rank on search engines. Since November of 2016, Google’s search algorithm ranks websites not just based on the performance of their desktop pages but of their mobile pages as well.

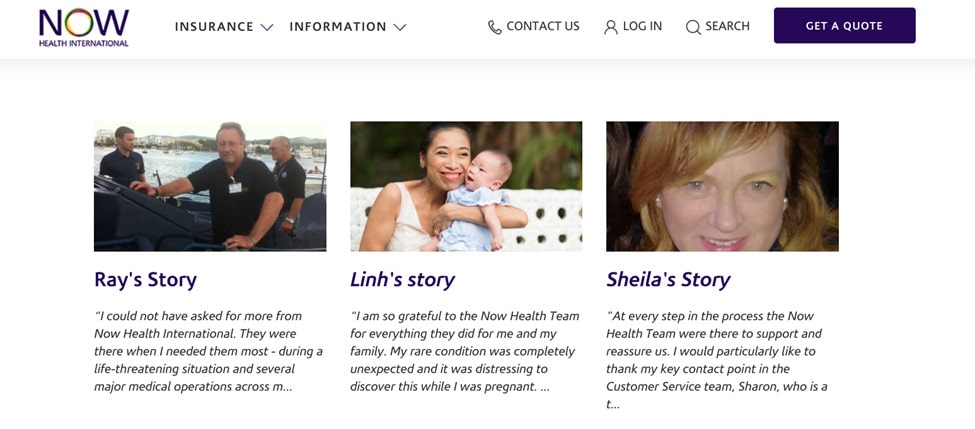

Use customer testimonials

To boost social proof and gain the prospect’s trust, collect positive customer feedback and make sure to share them across various channels, such as your website, social media, and landing pages, to boost credibility.

Here’s a great example from Now Health International. They have a dedicated section on their website with customer stories that describe the value of their health insurance.

Key themes from these stories include the company’s exceptional support and dedication to providing their customers with financial peace of mind in case of emergencies. As a result, a prospect that comes across these testimonials is more likely to trust Now Health International and book their first call with them.

2. Invest in organic growth with SEO

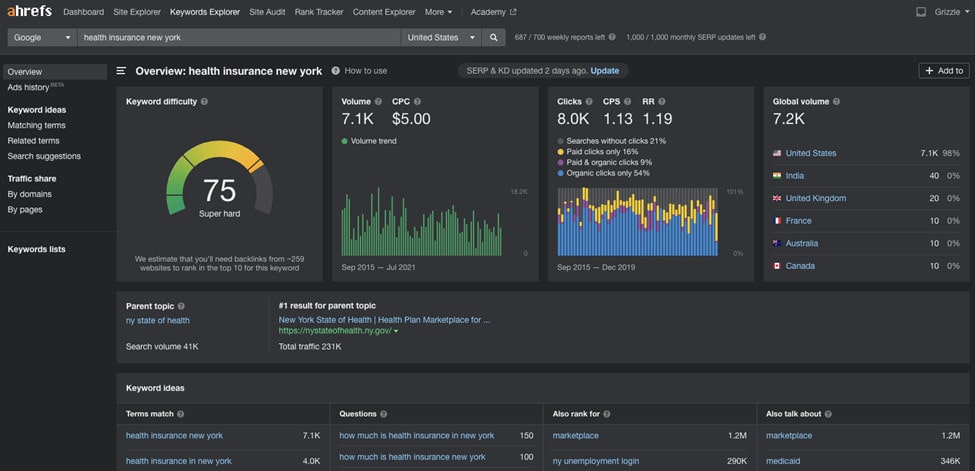

Search engine optimization (or SEO) involves optimizing your health insurance website for relevant search terms in your niche. Considering that, on average, 68% of trackable website traffic comes from a Google search (as opposed to social media and other channels), SEO is something you can’t neglect in your health insurance strategy.

The first step is to identify key search terms that your target audience uses to learn about all the different types of health insurance. You can use various tools to uncover this data, such as Ahrefs or Mangools, and find potential ranking opportunities.

For example, here’s what we get for the search query “health insurance new york,” which generates over 7,000 searches in the U.S. a month:

With this data, we can understand what we’d need to do to rank for this highly competitive term.

The next step will be to focus on ranking for these search terms through relevant content. The idea is to meet user intent through content on your website that users want to find as they’re searching these keywords on Google. The content you’re putting out can take the form of:

- Landing pages

- Blog posts

- Ebooks

- White papers

- Case studies

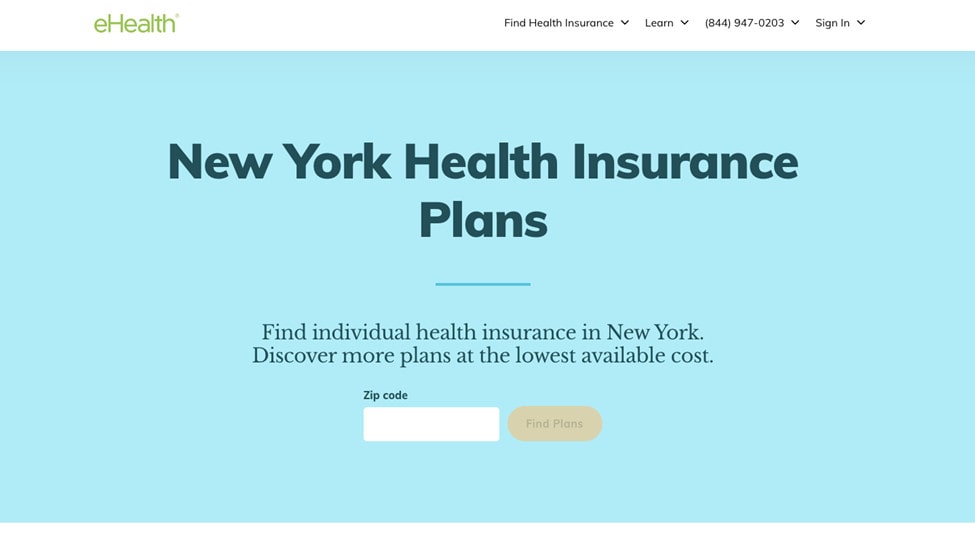

For example, here’s the top result for the term “health insurance new york” from eHealth:

Here they focus on one action for the user: enter your zip code to find the most affordable health insurance options in your area. It then does a great job of providing searchers with additional resources, giving them everything they need to know about their health insurance options in the state of New York.

Another important SEO strategy is to earn links from reputable sources to your website (called “backlinks”). The reason behind this tactic is that when an established website links to your page, it indicates to Google’s search engine that your site is highly regarded as well.

Collecting backlinks does require effort and usually means time spent reaching out personally to other websites and professionals in your health insurance niche.

3. Run PPC ad campaigns

While SEO is a necessary aspect of a health insurance strategy, it can take time to bear fruit. You’ll have to put in effort to research, create content and frequently look out for backlink opportunities.

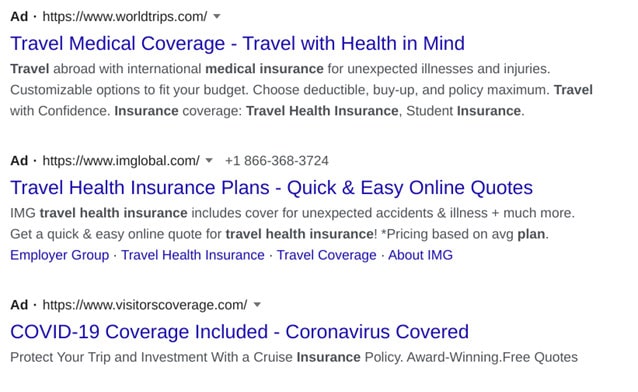

A strategy that drives results and complements perfectly with SEO is to run PPC digital advertising campaigns. With PPC, you can promote an ad on relevant niche search terms while paying a fee each time a user clicks on your ad. Here’s an example of what PPC looks like when we type in “travel health insurance” on Google:

By typing in the keyword, the user sees ads from various companies offering their travel health insurance. These ads show up at the top of the search results before any content from insurance companies. From there, they can click on an ad they think is most relevant to their needs, such as Covid-19 health coverage for their next trip.

Running PPC ads boosts your health insurance’s reach (even during algorithm changes), drives more traffic, and generates fast results. Even if you have a low domain rating, it also allows you to rank for competitive keywords.

That said, A/B testing is recommended to get the most out of your PPC ads. You’ll have to test four different factors: target keywords, the ad copy, your headline, and your website landing page. Key metrics you need to measure the success of your PPC ad campaigns include:

- Click-through rate (CTR). Your CTR is the number of visitors who click on your PPC ad divided by the number of people who saw it. A high CTR means that your audience finds your ad relevant and helpful, while a low CTR could mean you aren’t targeting the right audience or your ad copy isn’t persuasive enough to make them click.

- Bounce rate. Your bounce rate is the number of people that entered your website but left before they could view other pages. A bounce rate that’s too high is an indication that something is wrong with your landing page’s user experience. For example, your landing page isn’t optimized for mobile devices, or perhaps the page loading speed is too slow.

- Conversion rate. The conversion rate is the number of people who clicked on your ad and completed a desired action. For example, you could be tracking how many people book a call with your health insurance team or sign up for your email list. Each time the chosen task is completed, it’s called a conversion.

To measure these PPC metrics, you can use tools such as Wordstream or Optmyzr. Both allow you to automate the manual work that comes with running PPC campaigns, along with reporting to track your results.

4. Follow up with health insurance patients

An important part of your health insurance marketing strategy is to follow up with previous patients and get their thoughts on your offer.

You want to follow up with health insurance patients and collect their feedback to understand how you’re doing. Not only does this help inform your strategy and optimize your offer, but it also builds trust, encouraging customers to return instead of opting for the competition next time.

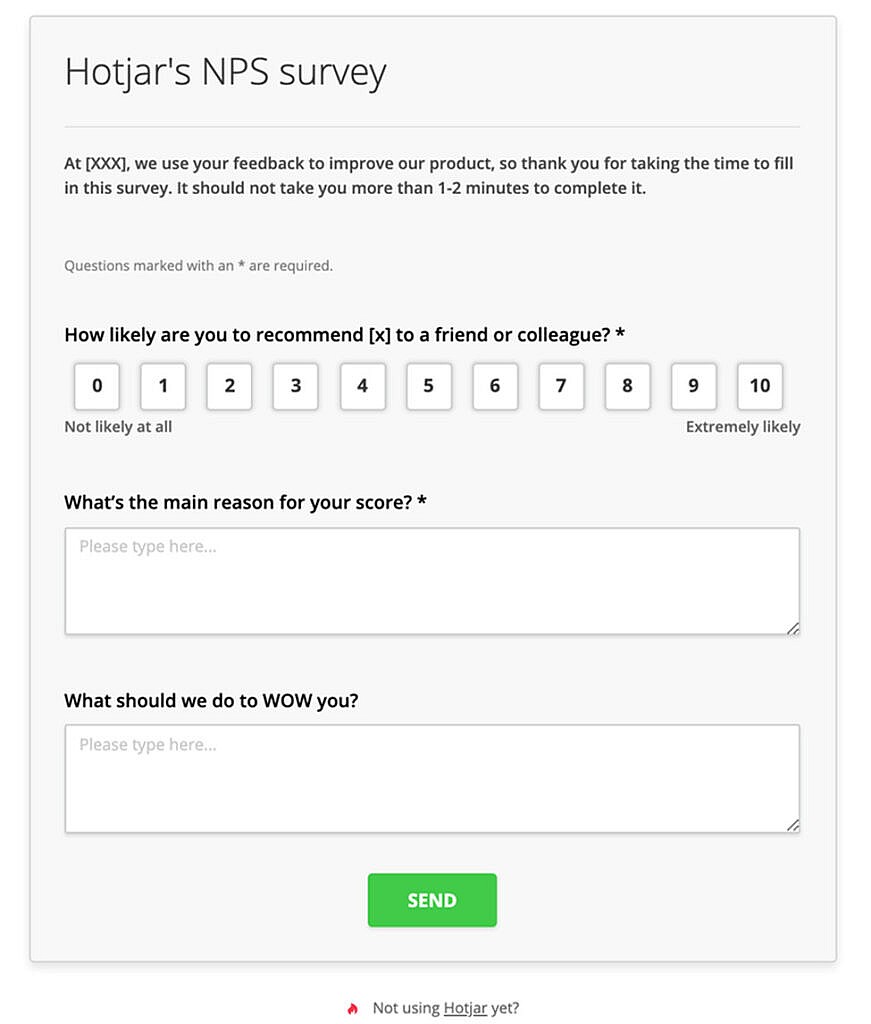

For example, you could ask them to complete a Net Promoter Score survey (NPS survey) or give you a customer satisfaction score (CSAT score) as a way of measuring the quality of your service.

Second, getting feedback from your patients allows you to find ways to improve your offer or customer experience. You can identify blind spots in the patient experience that you can then enhance to better meet their needs and expectations while improving retention.

Even if the patient previously had a bad experience with your health insurance company, following up with them and finding ways to solve the issue will put you in a good light. As a result, you’ll improve your brand reputation, and they might even consider redoing business with you.

5. Leverage co-marketing and partnerships to build authority in your health insurance niche

Authority is a critical factor in helping customers make the final decision to buy your insurance. You can develop strategic partnerships with other top companies in your health insurance niche to boost that trust.

LinkedIn is the best platform you can use to establish partnerships with others in your industry. You can then leverage the trust placed in them by their audience as a way to build your own authority in your health insurance niche. Here are steps you can follow to get started:

- Optimize your LinkedIn company page. Your company page is the first thing potential partners will see on LinkedIn. Make sure to optimize it the right way with a professional header image, making your health insurance niche clear, along with a detailed description of how your company helps its customers.

- Join groups in your industry. Follow and join relevant LinkedIn groups where you can connect with like-minded individuals in your industry. Search for active members in the group who might prove to be valuable partners.

- Share thought-leadership content. As you’re building more authority on LinkedIn, publishing content relevant to your industry is an excellent way to catch their attention. Ideas of content you can publish include interviews with health insurance experts, behind-the-scenes videos of how you get things done in your company, or personal insights.

- Engage with the potential partner’s content. Another great way to be on a potential connection’s radar is to engage with the content they’re publishing. That can include replying to comments or sharing their posts on your timeline.

- Explain why you want to collaborate. After engaging with them for a while and getting to know your prospective partner, it’s time to reach out to them with your ask. Make sure to explain the benefits that you both can get out of collaborating together.

While not health insurance specifically, Lemonade has a compelling partners program that rewards influencers, content creators, and traditional media brands.

It’s a compelling offer. Along with monetary rewards for referring new customers, they offer “transparent tracking” and assist with campaign content creation.

Create a compelling program that goes above and beyond. Make it easy for potential partners to say “yes.” This is how Lemonade attracts brands like Supermoney to partner with them.

6. Leverage doctor referrals

Don’t underestimate the power of word of mouth. Specifically in the health insurance space, you can leverage the trust that patients have in doctors.

Consider any doctors you can appeal to to become your brand advocates, professionals who spread the word about your healthcare insurance. It’s an organic way to boost awareness around your insurance company and acquire more customers.

An excellent way to do this is through a brand advocacy patient program. You can offer exclusive perks to patients that sign up for your health insurance via their doctor, such as a discount on their membership.

7. Use marketing tools to automate manual work

As you’re defining your health insurance marketing strategy, keep in mind that you don’t have to do all the tedious administrative work.

You can adopt various digital tools to help you out, such as those that enhance customer data collection or nurture prospects. Here’s a list of top tools we recommend for different aspects of digital marketing.

Email Automation

Email marketing is an essential part of any digital marketing strategy. With automation, you can maximize the results of your email strategy by creating a series of emails that are triggered based on your subscriber’s actions. In return, it helps build a more personalized experience. The best software solutions you can use to set this up are:

User survey tools

Collecting feedback from your health insurance patients is vital to measure the quality of your offer and find ways to improve, but following up with each patient by yourself will get tiresome quickly. Here are tools you can use to automate the process instead:

Marketing analytics

Data is essential to identify what’s working in your marketing campaigns and what’s not, so you can make the changes to improve your results. The solutions below help you understand the performance of your marketing efforts and create comprehensive reports that you can share with your team:

Key takeaways

It’s time to get rid of the old lead generation tactics.

To develop a health insurance customer acquisition strategy that drives enrollment, you need to be active on all the channels your audience uses to do their research. That includes channels such as search engines, email, and social media. You’ll also need to make sure your website is optimized for conversions once your prospects land on the page.

From there, you’ll have what it takes to skyrocket your digital transformation for your health insurance plan.

READY TO PROVIDE A BETTER POST-CLICK EXPERIENCE?

Get insights and tips to drive more business from less ad spend, more profit from less cost, and more customer value from less churn.