How Capital One Creates Memorable Customer Experiences

Who says finance CX can’t be captivating?

Sure, many financial brands treat you like a walking wallet. Every email screams “SIGN UP!” or “UPGRADE NOW!”

It’s exhausting.

But recently, something different happened that made me pay attention.

I’d just finished dinner at a restaurant and paid with my new Capital One credit card.

The bill was large, but I had a gift card to cover a good chunk of it.. I tipped according to the original bill and went on my way.

An hour later, my phone buzzed with an email.

“Did you mean to tip 50%?” asked Capital One. “Do you need help?”

They weren’t trying to sell me anything. They were leveraging one of their digital channels to look out for me.

The problem with always being in “seller” mode

Most brands operate like that friend who only calls when they need something.

Every touchpoint is a sales opportunity. Every email tries to extract value rather than deliver it.

It causes customers to develop promotional blindness, meaning they start tuning out because they know what’s coming.

Next thing you know, even the account notifications and security updates are going to spam.

Lots of financial services companies love pushing products—credit limit increases, new account offers, investment services, etc.

Capital One could’ve easily gone this route.

But they took a different approach entirely, and I’m a happier, more valuable customer for it.

Why helping always beats selling

That tip verification email worked on multiple psychological levels, whether Capital One realized it or not.

First, reciprocity kicked in.

When someone helps without being asked, you feel compelled to return the favor.

Capital One provided peace of mind without expecting anything of me. I repay them with loyalty.

Second, they built trust through unexpected value.

I wasn’t anticipating that email, but it showed that my bank was paying attention to my experience, not just my spending patterns.

That creates an emotional connection you can’t buy with traditional advertising.

Third, they trained my attention.

Now when I see a Capital One email, I instinctively open it.

Why?

Because they’ve established a track record of sending things that matter to me, not just things that matter to them.

Three pillars of value-first communication

The Capital One approach isn’t magic; it’s a systematic way of putting people first.

One with three solid pillars:

Pillar 1: Spotting problems before customers do

Don’t wait for customers to complain about their experiences. Anticipate issues and address them before they can hurt the relationship.

Capital One saw an unusual spending pattern and checked in. They could have done nothing and collected their transaction fee either way.

[potential screenshot]

Other examples of proactive problem solving are shipping delay notifications and security alerts.

Pillar 2: Educating, not pitching

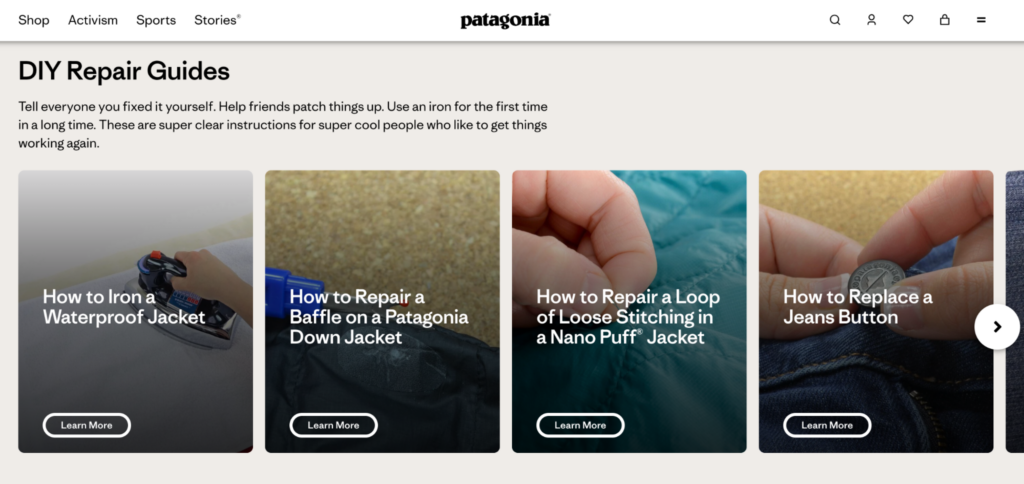

Patagonia educates brilliantly with clothing repair guides.

Rather than pushing customers toward new purchases when something breaks, the brand shows them how to fix it themselves.

As a result, they build loyalty while reducing waste (sustainability is central to Patagonia’s USP).

Your educational content must genuinely educate, not just set up another product pitch. The key word here is “genuinely.” Customers can smell thinly disguised sales pitches from miles away.

Pillar 3: Supporting the complete journey

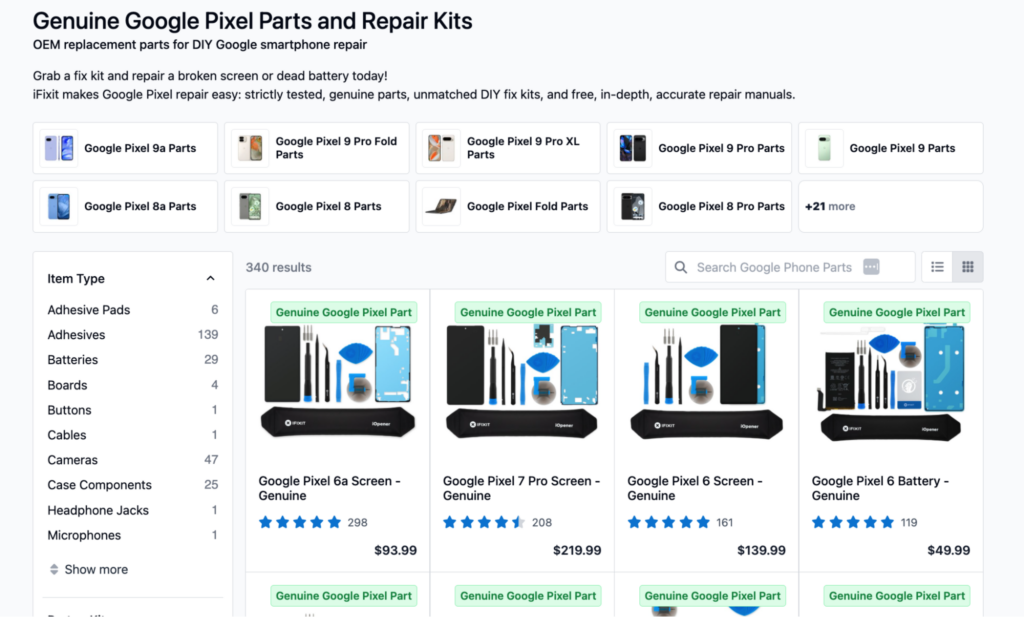

Google partnered with iFixit to make smartphone repairs more accessible.

Rather than encouraging people to buy new phones every time something breaks, they’re helping extend device lifecycles by providing original parts, repair kits, and expert guidance.

This approach recognizes that customer relationships extend far beyond the initial purchase.

The companies that win in the long term are thinking about the entire customer journey, not just the transaction.

How to be more like Capital One

Ready to flip the script on your customer comms?

Start here:

- Audit your current approach. Pull up your last 10 customer emails. How many offer value vs. ask for something? If the answer skews “ask,” you’ve found your problem.

- Invest in knowing your customers. That tip email worked because Capital One knew what was normal for me. To do the same with your audience, you’ll need data infrastructure that connects all the dots to create complete buyer profiles.

- Track engagement, not just sales. Value-first communication builds long-term relationships, so your metrics need to reflect that. Watch open rates, click-through rates, and customer lifetime value, not just immediate conversions.

And when you feel ready to make changes, resist the urge to overhaul everything at once.

Choose one moment in your customer journey where you could add value instead of extracting it.

Test it, measure the response, then expand from there.

The bottom line

Capital One turned a routine transaction into a moment of care. They chose to help rather than sell, and it worked (not least because I’m here in your inbox, sharing the story).

That tip verification email cost them pennies but earned something much more valuable: my attention and trust.

In a world where everyone’s fighting for customer attention, the brands that win and keep it are those that deserve it.

So, stop selling and start helping. I guarantee your customers will notice the difference.

READY TO PROVIDE A BETTER POST-CLICK EXPERIENCE?

Get insights and tips to drive more business from less ad spend, more profit from less cost, and more customer value from less churn.